Divya Saxena (Tilburg), Sungyong Chang (Cornell), Sendil Ethiraj (LBS)

Abstract

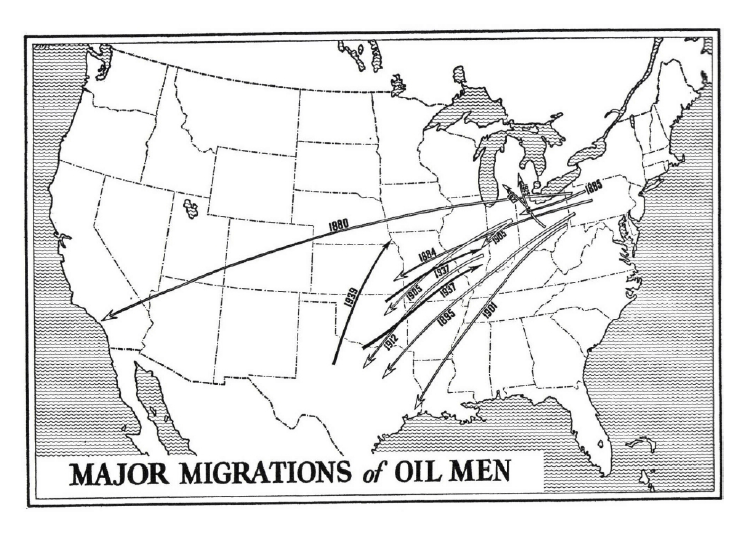

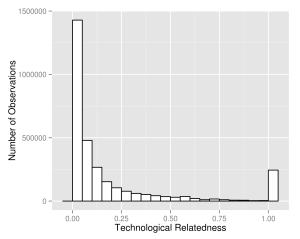

The difficulty of distant search and radical innovation for incumbent firms is a well-accepted assertion in the literature, primarily attributed to cannibalization risk and capability-driven inertia. This study explores the under-theorized role of capabilities in enabling distant search, independent of incentives. We examine the search behavior of firms in the U.S. oil exploration industry from 2008 to 2018, analyzing data from over 940,000 lease lands and drilling outcomes by 25,033 firms. Our findings indicate that, controlling for incentives, firms specializing in distant search are more successful, facing a lower likelihood of drilling dry holes compared to those focusing on local search. We identify key mechanisms underpinning distant search capabilities, including the use of trade secrets and the accumulation of experiential knowledge. Contrary to the notion that only incentives drive distant search, our results highlight the significant role of capabilities. This study contributes to the literature by providing empirical evidence that challenges the conventional understanding of organizational search behavior and by identifying specific capabilities that facilitate distant search, thereby informing managerial strategies and policy decisions to foster innovation.

Keywords: Distant search, Incumbent firms, Incentives view, Capabilities view, Oil Exploration Industry