(Based on the coauthored work with Sanghyun Park, National University of Singapore – SSRN working paper version)

In today’s interconnected digital economy, firms face unique challenges and opportunities as they expand internationally. While first-mover advantages are well-recognized, our research delves into how cross-country ties and network structures shape the early internationalization strategies of latecomers in global markets.

Breaking Down Network Effects

Network effects occur when a product or service becomes more valuable as more people use it. This concept is especially powerful in digital industries, such as mobile instant messaging (MIM), where user interaction drives adoption. However, network effects don’t always result in global dominance for first movers. In fragmented markets with limited cross-border connections, latecomers can thrive by strategically entering untapped regions.

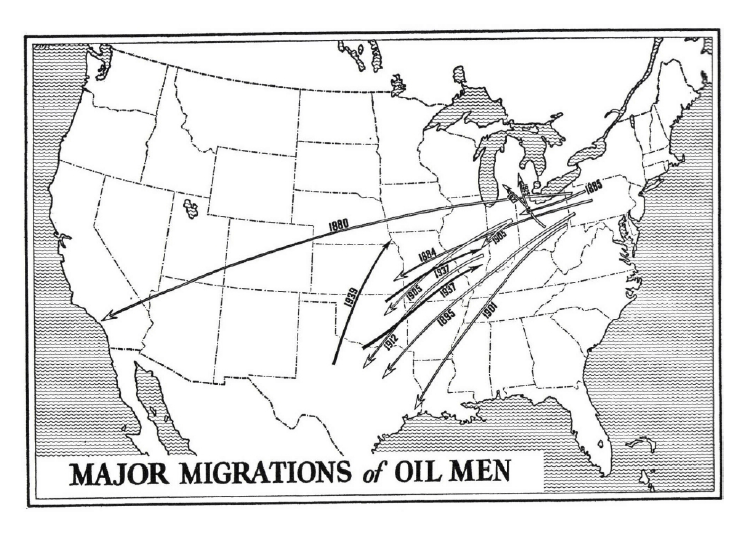

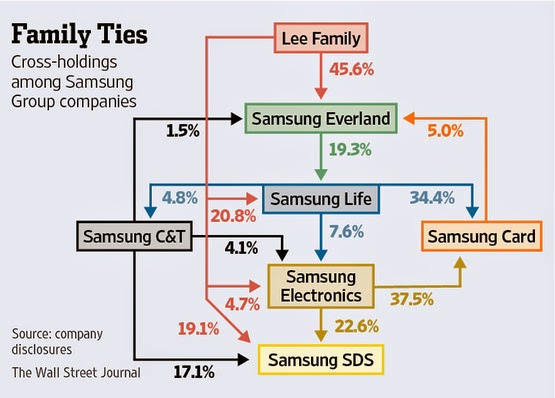

The Role of Cross-Country Ties

Our computational model highlights the importance of “bridges,” or connections between customer networks in different countries. Sparse cross-country ties can limit the spillover of network effects from one country to another. For example, Naver Line, a latecomer in South Korea’s MIM market, leveraged this fragmentation to dominate the Japanese market, avoiding head-to-head competition with South Korea’s leader, KakaoTalk.

Strategic Dilemmas for Latecomers

Latecomers face a trade-off:

- Survival Strategy: Early internationalization in fragmented markets can ensure survival by avoiding competition in saturated domestic markets.

- Dominance Challenge: However, focusing on survival might hinder their ability to achieve global leadership, especially in well-connected markets where first movers can capitalize on strong network effects.

Implications for Digital Firms

Understanding the structure of social networks and the level of cross-country ties is crucial for firms navigating global markets. By considering these demand-side factors, latecomers can craft strategies that balance survivability with the potential for market dominance.

Our findings underscore the nuanced dynamics of global competition in the digital age. Whether a firm is a first mover or a latecomer, success hinges on adapting to the intricate interplay of network structures and consumer behaviors.