Global Diversification Discount and Its Discontents:

A Bit of Self-selection Makes a World of Difference

Sungyong Chang, Bruce Kogut, and Jae-Suk Yang

Columbia Business School, Columbia University

Forthcoming, Strategic Management Journal

Abstract

The documented discount on globally diversified firms is often cited, but a correlation is not per se evidence that global diversification destroys firm value. Firms choose to globally diversify based on their firm attributes, some of which may be unobservable. Given these exogenous firm attributes, the decision to diversify globally is endogenous and self-selected. Using the same specifications save for the Heckman selection instrument, our results contradict past research that did not address endogeneity. We posit that the global premium should reflect the value of multinational operating flexibility. We use the 2008-2009 financial crisis as creating exogenous variation to permit a test for the positive change in firm valuation due to global diversification. During and after the 2008-2009 financial crisis, the premium associated with global diversification became larger and more significant than before the 2008-2009 financial crisis. The churn of subsidiaries entering and exiting countries increased during the crisis, pointing to the value of an operating flexibility to restructure the geography of the multinational network. In all, the results contradict past findings and finds evidence that operating flexibility is more valued during times of high volatility, thus generating the diversification premium.

Keywords: Global diversification; Self-selection; Operating flexibility; Financial crisis

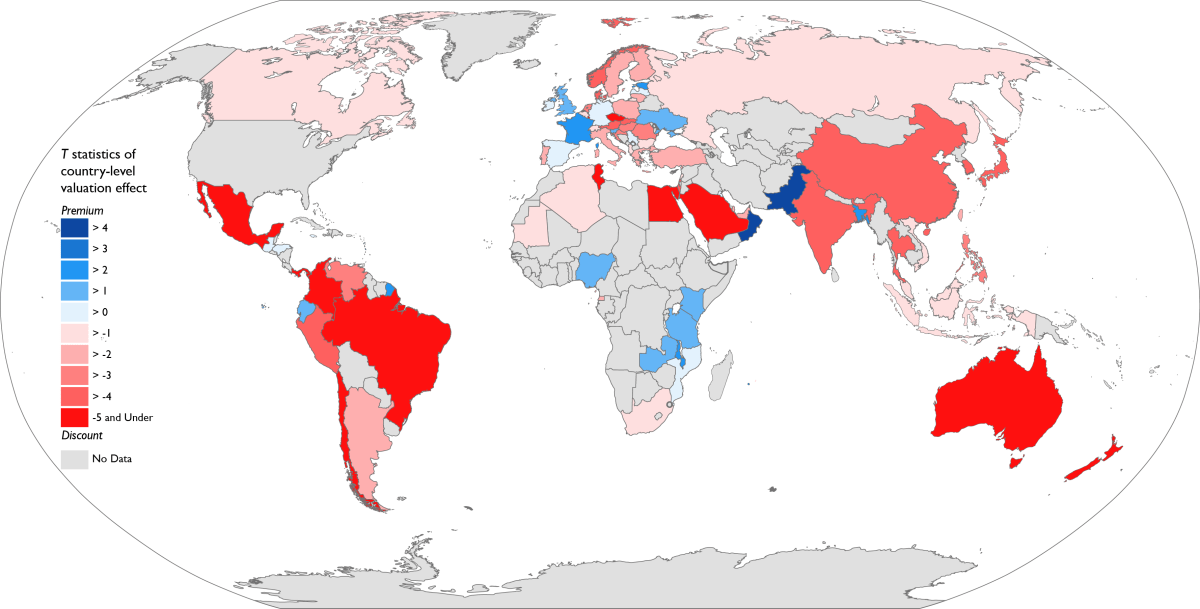

Figure 3. Country-level Valuation Effect of Global Diversification

Panel A. With Controlling Self-selection

Panel B. With Controlling Self-selection

Note: Color shows t-values. (Blue-Premium; Red-Discount, Grey-No data)